India water and wastewater treatment chemicals market stood at $ 597 million in 2019 and is projected to reach $ 986 million by 2026. Anticipated growth in the market can be attributed to rising population, increasing water contamination on account of rapid urbanization and industrialization, growing investments in sewage treatment plants and river cleaning programs, and strict government policies on polluted water discharge by industries. Some of the other factors that would positively influence the country’s water and wastewater treatment chemicals market in the coming years include the growing textile industry, favorable government policies, and a rising preference for green technology chemicals.

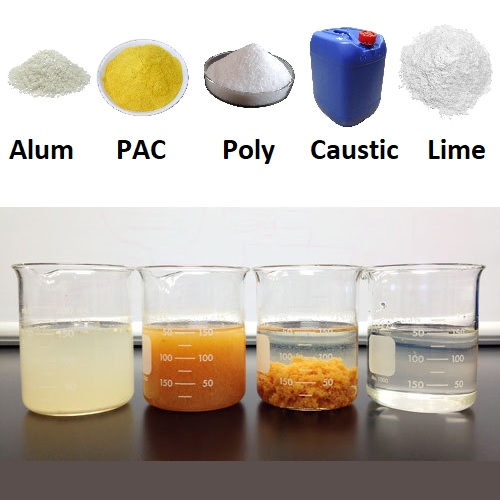

At present, there are numerous water and wastewater treatment chemical products such as corrosion & scale inhibitors, antiscalants, coagulants & flocculants, biocides and disinfectants, pH adjusters, and others. Amongst all the types, corrosion & scale inhibitors, and antiscalants are the two most widely used chemicals in India by end-user industries such as sugar, pharma, fertilizer, paper & pulp, and the oil & gas industry. In 2019, India corrosion & scale inhibitors used in various industrial applications accounted for more than 25% of India’s total water and wastewater treatment chemicals. The corrosion & scale inhibitor segment is also anticipated to grow at a robust pace in the coming years owing to its increasing demand from industrial sectors to prevent process pipelines from corrosion & scaling. Further, the continuously declining water levels and water quality is expected to propel demand for water & wastewater treatment chemicals in India during the forecast period.

Years considered for this report:

- Historical Years: 2013-2018

- Base Year: 2019

- Estimated Year: 2020

- Forecast Period: 2021-2026

The objective of the Study:

- To analyze and forecast India water and wastewater treatment chemicals market size.

- To define, classify and forecast India water and wastewater treatment chemicals market on the basis of product type, industry type, end use, sales channel, and regional distribution.

- To scrutinize the detailed market segmentation and forecast the market size, in terms of value, on the basis of region by segmenting India’s water and wastewater treatment chemicals market into four regions, namely, West, North, South and East.

- To identify major drivers, challenges, and trends in India water and wastewater treatment chemicals market.

- To understand major policies and regulations which can positively or negatively impact India water and wastewater treatment chemicals market.

- To evaluate average market selling prices in India water and wastewater treatment chemicals market.

- To strategically profile leading players operating in India water and wastewater treatment chemicals market.

Click here to download FREE sample @ https://www.techsciresearch.com/sample-report.aspx?cid=3120

Some of the major players operating in India water and wastewater treatment chemicals market include BASF India Ltd., Ion Exchange India Ltd., Thermax India Ltd., NALCO Water India Ltd., SUEZ India Pvt Ltd, Chembond Chemicals Ltd., VASU Chemicals (India) Pvt. Ltd., Solenis Chemicals India Pvt. Ltd., Vishnu Chemicals, Chemtex Speciality Ltd., SNF India Pvt Ltd. and Sicagen India Pvt Ltd. among others.

TechSci Research performed exhaustive primary as well as secondary research for this study. Initially, TechSci Research sourced a list of water and wastewater treatment chemical companies in India. Subsequently, TechSci Research conducted primary research surveys with the identified companies. While interviewing, the respondents were also enquired about their competitors. Through this technique, TechSci Research was able to include companies that could not be identified due to the limitations of secondary research. TechSci Research analyzed product offerings, end user and regional presence of all major suppliers of water and wastewater treatment chemicals across India.

TechSci Research calculated India water and wastewater treatment chemicals market size using a bottom-up approach, where manufacturers’ value sales data for different chemical types was recorded as well as forecast for the future years. Secondary sources such as company annual reports, Ministry of Corporate Affairs, Central Pollution Control Board, Ministry of Water Resources, Ministry of Finance, River Development and Ganga Rejuvenation, India Meteorological Department, World Bank, press releases, industry magazines, industry reports, news dailies, credible paid databases, etc., were also studied by TechSci Research.

Key Target Audience:

- Water and wastewater treatment chemicals manufacturers, distributors and other stakeholders

- Major end-users of water and wastewater treatment chemicals

- Associations, organizations and alliances related to water and wastewater treatment chemicals

- Government bodies such as regulating authorities and policy makers

- Market research and consulting firms

The study is useful in providing answers to several critical questions that are important for industry stakeholders, such as manufacturers, distributors and other stakeholders of water and wastewater treatment chemicals market. The study would also help them in deciding which market segments should be targeted over the coming years in order to strategize investments and capitalize on growth of the market.

Report Scope:

In this report, India water and wastewater treatment chemicals market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

- Market, by Type:

- Coagulants & Flocculants

- Antiscalants / Dispersants

- Biocides & Disinfectants

- Corrosion & Scale Inhibitors

- pH Adjusters

- Defoamers

- Others

- Market, by Industry Type:

- Water

- Wastewater

- Market, by End Use:

- Industrial

- Municipal

- Market, by Sales Channel:

- Direct

- Indirect

- Market, by Region:

- North

- South

- East

- West

Competitive Landscape

Competitive Benchmarking: Benchmarking of five leading players on the basis of product type offered.

Voice of Customer: Customer analysis by considering parameters, such as brand awareness, brand satisfaction and factors influencing purchase decision.

Company Profiles: Detailed analysis of the major companies operating in India water and wastewater treatment chemicals market.

Available Customizations:

With the given market data, TechSci Research offers customizations according to a company’s specific needs. The following customization options are available for the report:

Channel Partner Analysis

- Detailed list of distributors and dealers across the country.

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Related Reports

Stearic Acid Market {2028} – Analysis, Size, Trends, & Insights

Table of Content-India Water and Wastewater Treatment Chemicals Market

- Product Overview

- Research Methodology

- Analyst View

- Voice of Customer

4.1. Brand Awareness

4.2. Factors Influencing Purchase Decisions Brand

4.3. Brand Satisfaction

- India Water and Wastewater Scenario

- India Water and Wastewater Treatment Chemicals Market Outlook

6.1. Market Size & Forecast

6.1.1.By Value

6.1.2.By Volume

6.2. Market Share & Forecast

6.2.1.By Chemical Type (Coagulant & Flocculant, Biocide & Disinfectant, Antiscalant / Dispersant, Corrosion & Scale Inhibitor, pH Adjuster, Defoamer & Others)

6.2.2.By Industry Type (Water and Wastewater)

6.2.3.By End Use (Industrial (Oil & Gas, Pharma, Power, Steel, Chemicals, Sugar, Fertilizer, Paper & Pulp, FMCG etc.) & Municipal)

6.2.4.By Sales Channel (Direct & Indirect)

6.2.5.By Region

6.2.6.By Company

6.3. Market Attractiveness Index (By Chemical Type, By Industry Type, By End Use & By Region)

- India Corrosion & Scale Inhibitor Chemicals Market Outlook

7.1. Market Size & Forecast

7.1.1.By Value & By Volume

7.2. Market Share & Forecast

7.2.1.By End Use

7.2.2.By Industry Type

7.2.3.By Sales Channel

7.2.4.By Region

- India Biocide & Disinfectant Chemicals Market Outlook

8.1. Market Size & Forecast

8.1.1.By Value & By Volume

8.2. Market Share & Forecast

8.2.1.By End Use

8.2.2.By Industry Type

8.2.3.By Sales Channel

8.2.4.By Region

- India Coagulant & Flocculant Chemicals Market Outlook

9.1. Market Size & Forecast

9.1.1.By Value & By Volume

9.2. Market Share & Forecast

9.2.1.By End Use

9.2.2.By Industry Type

9.2.3.By Sales Channel

9.2.4.By Region

- India Defoamer Chemicals Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value & By Volume

10.2. Market Share & Forecast

10.2.1. By End Use

10.2.2. By Industry Type

10.2.3. By Sales Channel

10.2.4. By Region

- India pH Adjuster Chemicals Market Outlook

11.1. Market Size & Forecast

11.1.1. By Value & By Volume

11.2. Market Share & Forecast

11.2.1. By End Use

11.2.2. By Industry Type

11.2.3. By Sales Channel

11.2.4. By Region

- India Antiscalants / Dispersant Chemicals Market Outlook

12.1. Market Size & Forecast

12.1.1. By Value & By Volume

12.2. Market Share & Forecast

12.2.1. By End Use

12.2.2. By Industry Type

12.2.3. By Sales Channel

12.2.4. By Chemical Type (Condensed Polyphosphate, Phosphonate, Polycarboxylic, Others)

12.2.5. By Region

- Pricing Analysis

- Market Dynamics

14.1. Drivers

14.2. Challenges

14.3. Impact Analysis

- Markets Trends & Developments

- Policy & Regulatory Landscape

- Trade Dynamics

17.1. Imports

17.2. Exports

17.3. Trade Balance

- Value Chain Analysis

- Channel Partners

- India Economic Profile

- Competitive Landscape

21.1. Competitive Benchmarking

21.2. Company Profiles

21.2.1. NALCO Water India Ltd.

21.2.2. SUEZ India Pvt Ltd

21.2.3. Thermax India Ltd.

21.2.4. Ion Exchange India Ltd.

21.2.5. Chembond Chemicals Ltd.

21.2.6. VASU Chemicals (India) Pvt. Ltd.

21.2.7. BASF India Ltd.

21.2.8. Solenis Chemicals India Pvt. Ltd.

21.2.9. Chemtex Speciality Ltd.

21.2.10. Sicagen India Pvt Ltd.

21.2.11. SNF India Pvt Ltd.