North America:

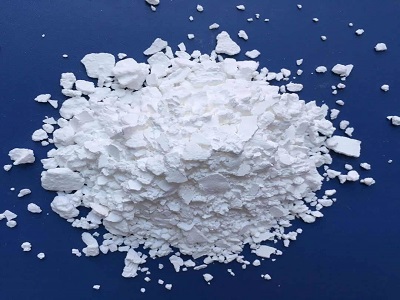

During the second quarter of 2023, the calcium chloride market in the United States exhibited mixed sentiments. In the early weeks of April, calcium chloride prices saw a 2.1% increase, primarily driven by a rise in crude oil prices, which moved from USD 74 to 79 within the first week of April. Furthermore, increased demand emerged from the downstream construction industry, as Limestone prices also surged by 2%. Adequate supply levels were maintained to meet both domestic and international market demands. However, as May and June unfolded, the price of calcium chloride adopted a bearish stance due to diminishing demand in the downstream construction sector. Market sentiments remained subdued, with investors anticipating another interest rate hike by the US Federal Reserve, contributing to economic uncertainty. Additionally, as the US transitioned into the summer season, the de-icing industries reduced their consumption of calcium chloride. Material availability was sufficient in the region, supported by consistent imports from China and Mexico. In June 2023, calcium chloride prices in DEL Texas settled at USD 315/MT.

APAC:

In the Asia-Pacific (APAC) region, calcium chloride prices also experienced mixed sentiments during the second quarter of 2023. In the early weeks of April, prices in the US market saw a 1.2% increase, closely tracking domestic coal prices, which rose from USD 138 to 139 in the first week of April. Improved demand from the downstream construction industry was observed, coinciding with increased prices for Limestone. Notably, the PMI Construction: Business expectations index improved from 63.7 to 64.0 in April. Adequate supply levels were maintained to cater to both domestic and international market requirements. However, as May and June progressed, calcium chloride prices adopted a bearish stance due to declining demand within the downstream construction sector. Retailer inquiries revealed high inventory levels of calcium chloride, largely influenced by warm weather conditions in Northern China. In the Indian market, prices in May and June also followed a bearish trend due to coal imports aimed at stabilizing energy prices and reduced demand from the construction industry, attributed to the onset of the monsoon and sowing season. Material availability remained sufficient to meet the needs of the construction industry. In June 2023, prices of Calcium Chloride FOB Qingdao settled at USD 150/MT.

Get Real Time Prices of Calcium Chloride: https://www.chemanalyst.com/Pricing-data/calcium-chloride-1297

Europe:

In the European market, calcium chloride prices displayed mixed sentiments during the second quarter of 2023. In the early weeks of April, prices in the Netherlands increased by 1.7% due to cost support from feedstock and gas prices. However, demand from the downstream construction industry decreased in April, as indicated by a 2% reduction in the CBS index for construction. Adequate supply levels were maintained to serve both domestic and international markets. As May and June unfolded, calcium chloride prices adopted a bearish stance, primarily influenced by negative cost dynamics associated with Limestone and energy prices. Market sentiments remained subdued, driven by ongoing economic slowdown and high inflationary pressures in Europe. Similar to the North American market, the de-icing industries reduced their calcium chloride consumption as summer progressed in Europe. Material availability remained sufficient, supported by consistent imports from China and the United States. In June 2023, prices of Calcium Chloride FD Rotterdam settled at USD 278/MT.

Contact Us:

ChemAnalyst

GmbH – S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: sales@chemanalyst.com

Website: https://www.chemanalyst.com