Global 1,4 butanediol market size was valued at USD 8.1 billion in 2023, which is expected to grow to USD 16.15 billion in 2031 with a CAGR of 9% during the forecast period between 2024 and 2031. The paints and coatings segment held a prominent share in the global 1,4 butanediol market in 2022. For instance, according to the recent statistics published by the World Paint & Coatings Industry Association (WPCIA), in 2022, the global paints and coatings industry was valued at USD 179.7 billion, representing a year-on-year growth rate of 3.1%.

Asia-Pacific held the dominant market position in the global 1,4 butanediol industry in 2022. According to Akzo Nobel India, a leading paints and coatings market in India, the paints and coatings market in India will reach USD 12.1 billion by 2027.

The benefits of 1,4 butanediol (BDO) in tetrahydrofuran (THF) production include its role as a key intermediate in the synthesis of various high-value polymers and fibers, as well as its use as a universal solvent and raw material for organic synthesis. Therefore, due to the various benefits offered by 1,4 butanediol, its adoption is increasing in THF production, which is a prime aspect augmenting the growth of the market. Additionally, the growth of the paints and coatings industry is accredited to factors such as an increase in the renovation rate, the recent expansion of paints and coatings manufacturing facilities, and a rise in residential construction activities. As a result, the advancing paints and coatings sector is boosting the demand for 1,4 butanediol (BDO) as it is a key ingredient in the paints and coatings product manufacturing. Henceforth, the surge in the demand for 1,4 butanediol (BDO) is supplementing the market growth.

The ongoing product development associated with bio-based 1,4 butanediol will create a favorable outlook for market growth in the long run. For instance, BASF SE has obtained long-term access to bio-based 1,4-butanediol (BDO) from Qore LLC, a joint venture of Cargill and HELM AG. Qore will produce the biobased BDO at Cargill’s biotechnology campus and corn refining operation in Iowa. This collaboration will allow BASF to expand its existing offer of BDO derivatives with bio-based variants, such as polytetramethylene ether glycol (polytetrahydrofuran, PolyTHF) and THF. The first commercial quantities will be available in Q1 2025. Nevertheless, health concerns associated with 1,4 butanediol are restraining the growth of the market.

Get Full Research report: https://www.marketsandata.com/industry-reports/1-4-butanediol-market

Rising Adoption of 1,4 Butanediol in THF is Accelerating the Market Growth

The production of THF from 1,4 butanediol offers a sustainable and environmentally friendly approach, particularly when bio-based methods are employed for the synthesis of 1,4 butanediol and THF. These bio-based processes contribute to the development of low-carbon and energy-efficient production methods, aligning with the principles of green chemistry. The rising adoption of 1,4 butanediol in the production of THF is attributed to the growing demand for THF in various applications such as the manufacturing of plastics, pharmaceuticals, and textiles. The increased use of THF in the above-mentioned industries has led to a higher demand for 1,4 butanediol as a key raw material for its production. This trend is expected to continue as these industries expand, driving the adoption of 1,4 butanediol for THF production.

For instance, according to the recent statistics published by Plastics Europe, a global association for plastics production, in 2021, the total global level of plastics production was 394 million tons, and in 2022, it was 400.3 million tons, an increase of 1.6%.

Ongoing Development of New Lithium-ion Manufacturing Facilities Spurring the Market Growth

1,4 butanediol (BDO) is used in electrodes for lithium-ion battery manufacturing. The increasing adoption of electric vehicles and the development of new electronics manufacturing facilities will propel the deployment of lithium-ion batteries. As a result, lithium-ion battery manufacturers are leveraging their investments for the new manufacturing facility development, which will create a lucrative opportunity for market growth in the coming years as the demand for 1,4 butanediol (BDO) will increase in electrodes.

For instance, in January 2024, Arizona KOREPlex, a battery manufacturer in the United States, announced its plans to open a new lithium-ion battery manufacturing facility in Arizona, United States. In November 2023, Forge Nano, Inc., a prominent materials science company in the United States announced its plans to launch a new lithium-ion battery manufacturing facility in North Carolina, United States. The overall investment cost of the lithium-ion battery manufacturing facility is more than USD 165 million. In addition, in September 2023, Gotion High-tech Co Ltd announced the development of a USD 2 billion lithium-ion battery manufacturing facility in Illinois, the United States by 2024.

Download Free Sample Report: https://www.marketsandata.com/industry-reports/1-4-butanediol-market/sample-request

Booming Paints and Coatings Sector is Fostering the Market Growth

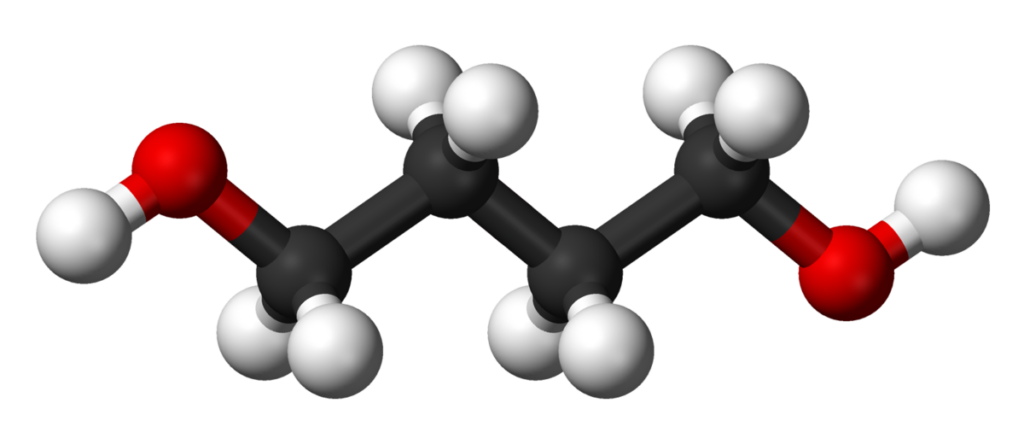

The key technical properties associated with 1,4 butanediol include a molar mass of 90.122 g·mol−1, density at 1.0171 g/cm3 (20 °C), melting point of 20.1 °C (68.2 °F; 293.2 K), boiling point at 235 °C (455 °F; 508 K), and miscible solubility in water. Thus, 1,4 butanediol (BDO) is an important component in the production of paints and coatings. The 1,4 butanediol is ideal for paints and coatings products such as industrial, surface, and special purpose paints and coatings. The increasing demand for architectural paints and coatings, rising construction activities, and the surging spending power of people are the key determinants spurring the paints and coatings market growth.

For instance, according to the recent statistics published by the World Paint & Coatings Industry Association (WPCIA), the Asia-Pacific paints and coatings market was the leading region, valued at USD 63 billion in 2022. China dominated the Asia-Pacific regional market, which grew at a CAGR of 5.8%. The European region was the second largest market for the paints and coatings industry, valued at USD 42.37 billion in 2022. In addition, the North American paints and coatings sector was the third largest market in the global ranking, valued at USD 33.92 billion in 2022. Hence, the booming paints and coatings industry is driving the demand for 1,4 butanediol worldwide as a cross-linking agent, thereby accelerating the market growth.

The Dominance of the Asia-Pacific Region in the Overall Market

Asia-Pacific is experiencing rapid growth in various industries, such as textiles, electronics, and automotive, which are major consumers of 1,4 butanediol, thereby driving the revenue growth of the market. Also, the Asia-Pacific region offers low-cost labor and resources, making it an attractive destination for 1,4 butanediol. Therefore, Asia-Pacific countries, such as India, China, and Japan, are the major hubs for manufacturing 1,4 butanediol.

Factors, such as the development of new manufacturing facilities for the production of lithium-ion batteries, increasing production of plastics, and surging output for adhesives and sealants, among others, are mainly accelerating the growth of the 1,4 butanediol market across the Asia-Pacific region. For instance, according to the recent 2023 data published by Plastics Europe, the global production of plastics in 2022 was 400.3 million tons and the Asia-Pacific region was the dominant market, holding a share of 54% of the global plastics production. Furthermore, China held about 33% share in the global plastics production. Therefore, the booming end-use industries in the Asia-Pacific region are amplifying the growth of the 1,4 butanediol market.

1,4 Butanediol (BDO) serves as a vital building block in the production of various chemicals and polymers, contributing significantly to industries such as automotive, textile, pharmaceuticals, and cosmetics. With its versatile applications and increasing demand across diverse sectors, the global market for 1,4 Butanediol is experiencing substantial growth. In this blog post, we delve into the driving factors behind the rising demand for 1,4 Butanediol and its implications for the global market.

1. Booming Chemical Industry: The chemical industry serves as a primary consumer of 1,4 Butanediol, utilizing it in the production of polymers, resins, and solvents. As the global economy continues to grow, driven by industrialization, urbanization, and technological advancements, the demand for chemicals derived from 1,4 Butanediol is expected to rise, supporting market growth.

2. Increasing Applications in Polymers and Plastics: 1,4 Butanediol is a key ingredient in the synthesis of polyurethane (PU) and thermoplastic polyurethane (TPU), which find extensive applications in automotive parts, construction materials, footwear, and upholstery. With the growing demand for lightweight, durable, and high-performance materials, particularly in the automotive and construction sectors, the demand for 1,4 Butanediol-based polymers is on the rise.

3. Rising Demand in Pharmaceutical and Personal Care Products: In the pharmaceutical and personal care industries, 1,4 Butanediol serves as a precursor for the production of various drugs, cosmetics, and hygiene products. It is used as a solvent, humectant, and preservative in pharmaceutical formulations, skincare products, and detergents. With increasing consumer awareness about health and hygiene, coupled with advancements in pharmaceutical research and development, the demand for 1,4 Butanediol in these industries is witnessing steady growth.

4. Shift towards Bio-based and Sustainable Alternatives: Amid growing environmental concerns and regulatory pressure to reduce carbon emissions, there is a rising interest in bio-based and sustainable alternatives to conventional petrochemicals. Bio-based 1,4 Butanediol, derived from renewable feedstocks such as biomass and sugar, offers a greener and more environmentally friendly solution. As companies strive to enhance their sustainability credentials and meet consumer demands for eco-friendly products, the market for bio-based 1,4 Butanediol is gaining momentum.

5. Technological Advancements and Process Innovations: Advancements in chemical engineering and process technology are driving efficiencies in the production of 1,4 Butanediol, leading to cost reductions and improved product quality. Novel production methods, such as bioconversion and fermentation, are expanding the scope of 1,4 Butanediol production, enhancing supply chain resilience and market competitiveness.

Conclusion: In conclusion, the global demand for 1,4 Butanediol is witnessing significant growth, fueled by its diverse applications across industries, technological advancements, and sustainability considerations. As industries continue to prioritize performance, efficiency, and environmental responsibility, 1,4 Butanediol remains a crucial ingredient in driving innovation and meeting the evolving needs of a rapidly changing world. With ongoing investments in research and development, market players are well-positioned to capitalize on emerging opportunities and contribute to the sustainable growth of the global 1,4 Butanediol market.

Contact

Mr. Vivek Gupta

5741 Cleveland street,

Suite 120, VA beach, VA, USA 23462

Tel: +1 (757) 343–3258

Email: info@marketsandata.com

Website: https://www.marketsandata.com