India Engineering Plastics market is anticipated to grow significantly in the projected period 2028 due to the growing popularity of bioplastic, increasing acceptance of engineering plastics over traditional plastics, Bolstering the manufacturing sector, and growing demand from end-user industries such as automotive, electrical & electronics, and consumer goods. According to the Government of India, India is the third largest consumer of plastic after USA and China where almost an average Indian consumes 13 kg annually versus 27 kg globally.

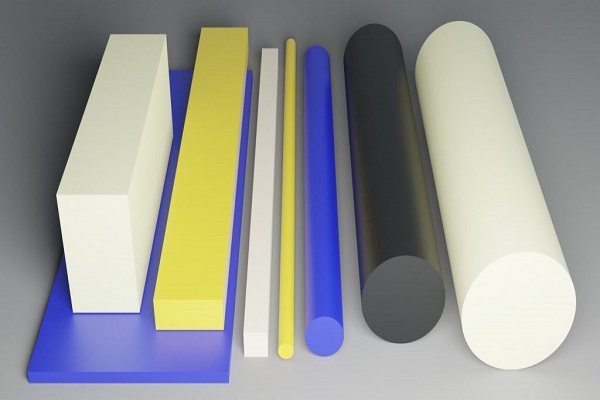

Engineering plastics are categorized as high-performance polymer that possesses superior mechanical, high thermal resistance, excellent insulation, and better chemical properties than the alternative. As a result, engineering plastics are widely used in various industries due to their exceptional performance characteristics. Engineering plastics demonstrate an excellent mechanical properties such as high strength and stiffness. It possesses a high strength capacity that withstands heavy loads and provides structural integrity in applications where strength is necessary. Their high stiffness allows for dimensional stability and resistance to deformation under mechanical stress.

Compared to traditional materials such as metals, engineering plastics have a lower density, making them lightweight. This property is particularly advantageous in industries such as automotive, aerospace, and transportation, where reducing weight can lead to improved fuel efficiency, higher payloads, and increased performance. Many engineering plastics tolerate the exposure of various chemicals, solvents, acids, and bases as they have excellent chemical resistance. Apart from this, they can retain their properties even in harsh environments and make themselves a suitable substitute for applications that involve contact with chemicals or corrosive substances.

Owing to good thermal stability, engineering plastics-based products allows them to retain their properties at high temperatures. They have higher melting points compared to standard plastics and can withstand elevated temperatures without significant deformation or degradation. This characteristic makes them suitable for applications that require heat resistance like engine components, electrical insulators, and industrial machinery. Many engineering plastics possess excellent electrical insulation properties and exhibit high dielectric strength, low electrical conductivity, and good resistance to electrical arcing. Such properties make them valuable for electrical and electronic applications and are used for manufacturing insulators, connectors, circuit boards, and other components. This in turn is expected to drive the demand and growth of India Engineering Plastics Market.

Download FREE Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=1446

Engineering plastics can be easily molded into complex shapes and allows manufacturers greater design flexibility. They can be manufactured using various processes, including injection molding, extrusion, and blow molding. This versatility enables the production of intricate parts and components with specific geometries. Hence, it provides an advantage to manufacturers in reducing the need for additional machining operations and lowering their operating costs. Engineering plastics have excellent impact resistance that makes them suitable for applications that require durability and toughness. They can withstand sudden shocks and impacts without breaking or cracking, ensuring long-lasting performance in demanding environments.

Due to low friction properties and excellent wear resistance, these characteristics make them suitable for applications that involve sliding or rubbing contact, including gears, bearings, and seals. The low friction helps reduce energy losses and improve overall efficiency, while the wear resistance extends the service life of components. The Indian Engineering Plastics market is a significant part of the country’s chemical industry, which is one of the largest in the world.

Rising Manufacturing Sector of India is a Key Factor that Driving the India Engineering Plastics Market Growth

The rising manufacturing sector in India is indeed driving the growth of the engineering plastics market in the country. According to Macrotrends, Indian manufacturing output for 2021 was estimated to be USD 443.91 billion which is a 21.61% increase from 2020. India’s manufacturing sector has been experiencing significant growth due to the country’s industrialization and economic development. Various industries such as automotive, electrical and electronics, packaging, consumer goods, and construction rely on engineering plastics for their specific applications. The demand for engineering plastics rises to cater to the diverse needs of these industries as the manufacturing sector expands.

Engineering plastics are increasingly being used as substitutes for traditional materials like metals and ceramics. They offer advantages such as lower weight, improved corrosion resistance, reduced friction, and enhanced design flexibility. The annual consumption of the polymer in India is accounted to be 16 million material is expected to be 16 million metric tons (MMTPA) in 2019 of which 90% is plastic and 10% is non-plastic. Manufacturers in India are recognizing the benefits of using engineering plastics in their products to optimize performance, reduce costs, and increase efficiency. This trend has led to a growing demand for engineering plastics in the manufacturing sector.

The automotive sector is a major consumer of engineering plastics and is used in applications such as interior and exterior parts, electrical components, under-the-hood parts, and lightweight initiatives. As India’s automotive industry continues to grow, the demand for engineering plastics in the production of automobiles and components increases driven by factors like rising disposable incomes, urbanization, and government initiatives. Hence, the expansion of the automotive industry directly contributes to the growth of the engineering plastics market.

In India, there is a significant amount of investment in infrastructure development, including roads, bridges, railways, airports, and housing projects. Due to their durability, corrosion resistance, and design versatility, engineering plastics find extensive use in infrastructure applications. Hence, increasing infrastructure projects will propel the demand for engineering plastics for construction and infrastructure-related applications in India.

Furthermore, the rise in disposable incomes, changing lifestyles, and the growth of the e-commerce sector are fueling the demand for consumer goods and packaging in India. Engineering plastics play a vital role in manufacturing durable consumer goods such as appliances, electronics, furniture, and sporting goods. They are also used in packaging materials for their excellent barrier properties, impact resistance, and design versatility. The expansion of the consumer goods and packaging sectors contributes to the increased consumption of engineering plastics. Therefore, the growing demand from the textile industry is a key driver for the Indian engineering plastics market, and this trend is expected to continue in the projected period.

Favorable Government Initiatives are Impacting the Indian Engineering Plastics Market Growth

Government initiatives in India have played a significant role in propelling the growth of the engineering plastics market. The “Make in India” campaign, launched by the Government of India, aims to transform the country into a global manufacturing hub. It encourages both domestic and foreign companies to invest in various sectors, including manufacturing. This initiative has led to increased industrialization, expansion of manufacturing facilities, and the establishment of new production units which drive the increased demand for engineering plastics in the country.

The National Manufacturing Policy (NMP) focuses on enhancing the competitiveness of the manufacturing sector in India. It aims to create an enabling environment for investment and promote innovation, skill development, and technology adoption. The policy also emphasizes the development of advanced manufacturing technologies and encourages the use of high-performance materials like engineering plastics. This support from the government has stimulated the demand for engineering plastics in India.

The Indian government has been actively investing in infrastructure development, including roads, bridges, railways, ports, and airports. These infrastructure projects require durable and high-performance materials like engineering plastics for applications such as construction, electrical components, and transportation. The government’s focus on infrastructure development has created a significant demand for engineering plastics in the country.

The Indian government has taken initiatives such as DST’s Plastic Technology Programme, to promote research and development (R&D) activities in various sectors, including manufacturing. R&D support encourages innovation, technological development, and the use of advanced materials like engineering plastics in different industries. This support has led to the development of new products, improved manufacturing processes, and increased adoption of engineering plastics in diverse applications.

The government has implemented skill development programs to enhance the technical capabilities of the workforce. These initiatives focus on providing training and education in manufacturing and related industries & institutions such as CIPET, and Pradhan Mantri Kaushal Vikas Yojna Center. The availability of a skilled workforce with knowledge of engineering plastics promotes their usage and adoption in manufacturing processes.

These government initiatives and policies have created a favorable environment for the growth of the engineering plastics market in India. They have stimulated investments, encouraged innovation, improved infrastructure, streamlined business processes, and enhanced the competitiveness of the manufacturing sector. The combined effect of these factors has propelled the demand for engineering plastics and supported the Indian engineering plastics market growth.

Recent Development

In 2022, Radici Group acquired the engineering plastics business of India’s Ester Industries Ltd. for USD 37 million. Through this acquisition, Ester Industries get ownership of a production site in Gujarat and increase its portfolio of engineering plastics, including polyamide, polyester, and other materials. Another, this acquisition helps the company to expand its presence in the growing Indian market for engineering plastics.

In 2021, BASF India completed the acquisition of BASF Performance Polyamides India Private Limited for USD 41 million. BASF Performance Polyamides India is a manufacturer of polyamide 6.6 resins and compounds that are used in a variety of applications, including automotive, electrical & electronics, and industrial. The acquisition will strengthen BASF India’s position in the polyamide market in India and expand its product portfolio.

Market Segmentation

India Engineering Plastics market is segmented based on type, process type, textile types, sales channel, end use, and region. Based on the type, the India Engineering Plastics market is divided into colorants and auxiliaries. Based on the process type, the India Engineering Plastics market is divided into pre-treatment, dyeing & printing, and finishing. Based on the textile type, the India Engineering Plastics market is divided into fabric, yarn, fiber, and composites. Based on the sales channel, the India Engineering Plastics market is divided into direct and indirect. Based on the end use, the India Engineering Plastics market is divided into clothing, construction, packaging, home furnishing, agriculture, and others.

Company Profiles

Archroma India Pvt. Ltd, Croda Chemicals (India) Private Limited, Huntsman International, India Private Limited, Rossari Biotech Ltd., CHT India Pvt. Ltd., Kiri Industries, Bodal Chemicals Limited, Indofil Industries Limited, Fibro organic (India) Pvt. Ltd., and Jaysynth Dyestuff (India) Limited are some of the key players of India engineering plastics market.

| Attribute | Details |

| Base Year | 2023 |

| Historic Data | 2019 – 2022 |

| Estimated Year | 2024 |

| Forecast Period | 2025 – 2029 |

| Quantitative Units | Revenue in USD Million, and CAGR for 2019-2022 and 2025-2029 |

| Report coverage | Revenue forecast, Company shares, competitive landscape, growth factors, and trends |

| Segments covered | Polymer Type

End Use Industry |

| Regional scope | East, West, North, South |

| Key companies profiled | Archroma India Pvt. Ltd, Croda Chemicals (India) Private Limited, Huntsman International, India Private Limited, Rossari Biotech Ltd., CHT India Pvt. Ltd., Kiri Industries, Bodal Chemicals Limited, Indofil Industries Limited, Fibro organic (India) Pvt. Ltd., and Jaysynth Dyestuff (India) Limited |

| Customization scope | 10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Scope:

In this report, India Engineering Plastics market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:

- India Engineering Plastics Market, By Type:

- Colorants

- Auxiliaries

- India Engineering Plastics Market, By Process Type:

- Pre-treatment

- Dyeing & Printing

- Finishing

- India Engineering Plastics Market, By Textile Type:

- Fabric

- Yarn

- Fiber

- Composites

- India Engineering Plastics Market, By Sales Channel:

- Direct

- Indirect

- India Engineering Plastics Market, By End Use:

- Clothing

- Construction

- Packaging

- Home Furnishing

- Agriculture

- Others

- India Engineering Plastics Market, By Region:

- East

- West

- North

- South

Competitive landscape

Company Profiles: Detailed analysis of the major companies in India Engineering Plastics market.

Available Customizations:

With the given market data, TechSci Research offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Related Reports

Hair Fixative Polymers Market [2028]: Trends & Forecast

Cosmetic Chemicals Market [2028] – Forecast & Projected Growth

Table of Content-India Engineering Plastics Market

- Product Overview

1.1. Market Definition

1.2. Scope of the Market

1.2.1. Markets Covered

1.2.2. Years Considered for Study

1.2.3. Key Market Segmentations

- Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

- Executive Summary

3.1. Overview of the Market

3.2. Overview of Key Market Segmentations

3.3. Overview of Key Market Players

3.4. Overview of Key Regions

3.5. Overview of Market Drivers, Challenges, Trends

- Voice of Customer

- India Engineering Plastics Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value & Volume

5.2. Market Share & Forecast

5.2.1. By Polymer Type (ABS, Polycarbonate, SAN, Polyamide, PBT, and Others)

5.2.2. By End Use Industry (Automotive, Electrical & Electronics, Consumer Goods, and Others)

5.2.3. By Region (East, West, North, South)

5.2.3.1. By States (Top 3 States)

5.2.4. By Company (2023)

5.3. Market Map

5.3.1. By Polymer Type

5.3.2. By End Use Industry

5.3.3. By Region

- India Acrylonitrile-Butadiene Styrene (ABS) Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value & Volume

6.2. Market Share & Forecast

6.2.1. By End Use Industry

- India Polycarbonate Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value & Volume

7.2. Market Share & Forecast

7.2.1. By End Use Industry

- India Styrene Acrylonitrile (SAN) Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value & Volume

8.2. Market Share & Forecast

8.2.1. By End Use Industry

- India Polybutylene Terephthalate (PBT) Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value & Volume

9.2. Market Share & Forecast

9.2.1. By End Use Industry

- India Polyamide Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value & Volume

10.2. Market Share & Forecast

10.2.1. By End Use Industry

- Market Dynamics

11.1. Drivers

11.2. Challenges

- Market Trends & Developments

- Pricing Analysis

- Import-Export Analysis

14.1. ABS

14.2. Polycarbonate

14.3. SAN

14.4. Polyamide

14.5. PBT

- India Engineering Plastics Market: SWOT Analysis

- Porter’s Five Forces Analysis

16.1. Competition in the Industry

16.2. Potential of New Entrants

16.3. Power of Suppliers

16.4. Power of Customers

16.5. Threat of Substitute Products

- Competitive Landscape

17.1. Business Overview

17.2. Product Offerings

17.3. Recent Developments

17.4. Financials (In Case of Listed Companies)

17.5. Key Personnel

17.5.1. Gujarat Fluorochemicals Limited

17.5.2. Styrolution ABS (INDIA) Limited

17.5.3. BASF India Limited

17.5.4. Bhansali Engineering Polymers Limited

17.5.5. Envalior (DSM Engineering Materials and LANXESS High Performance Materials)

17.5.6. LG Polymers India Pvt. Ltd.

17.5.7. Radici Plastics India Pvt. Ltd.

17.5.8. Ensinger India Engineering Plastics Pvt Ltd.

17.5.9. E. I. DuPont India Private Limited

17.5.10. APPL Industries Limited